- 2018/19 was a challenging year for the OFCA Trading Fund. The profit for the year fell to HK$30.8 million from HK$40.9 million in 2017/18. The rate of return on average net fixed assets ("ANFA") decreased to -0.8% from 11.9% a year before. This was primarily the result of increased operating expenditure and partly offset by an increase in revenue.

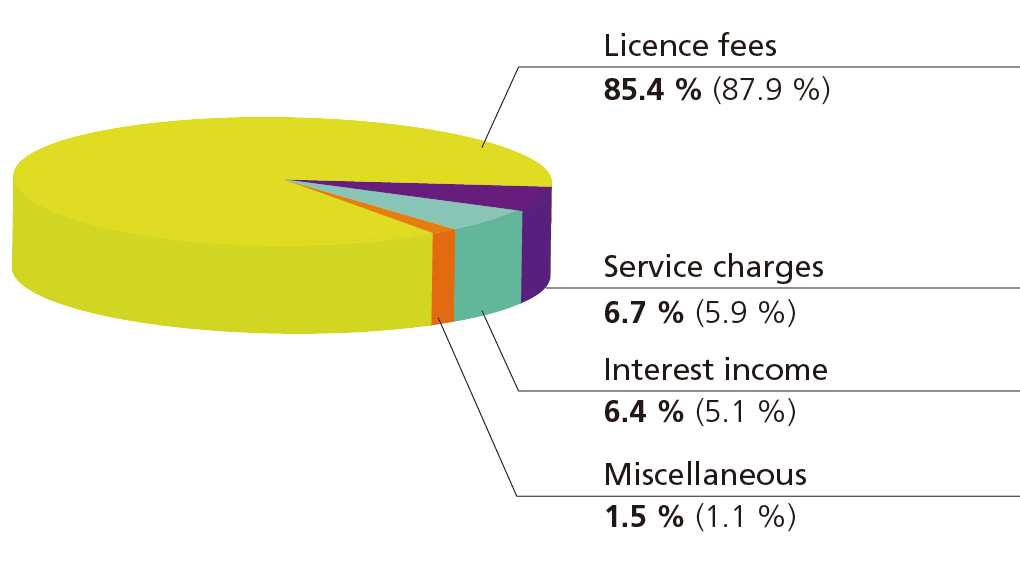

- The total revenue at HK$499.7 million was higher than the amount of HK$476.2 million last year due to increase in revenue from licence fees and services provided to related parties as well as interest income from the placement with the Exchange Fund and bank deposits.

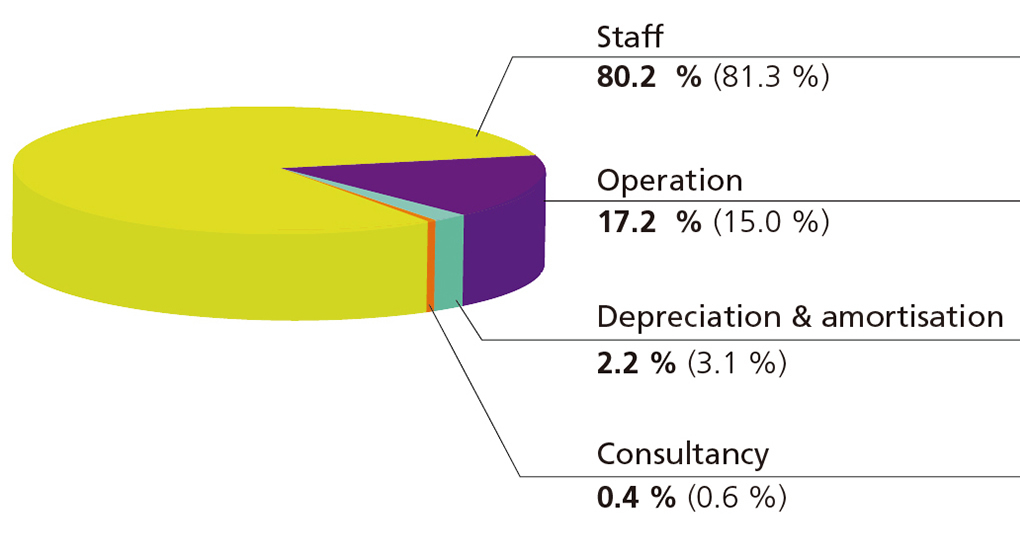

- On the expenditure side, the total expenditure rose by 7.7% to HK$468.9 million in 2018/19 mainly due to increase in staff costs and administrative expenses.

- Looking ahead, with the anticipated launch of 5G mobile communications services, in the short term we are optimistic that the communications sector in Hong Kong will enter a new era and remain vibrant and dynamic. With a dedicated and professional team in OFCA, we are well placed to face the challenges in the coming year.

Highlights of the financial performance:

| Description | 2018/19 HK$'m |

2017/18 HK$'m |

|---|---|---|

| Revenue | 499.7 | 476.2 |

| Expenditure | 468.9 | 435.3 |

| Profit | 30.8 | 40.9 |

| Return on ANFA | -0.8% | 11.9% |

Revenue

Expenditure

* In parentheses are 2017/18 figures