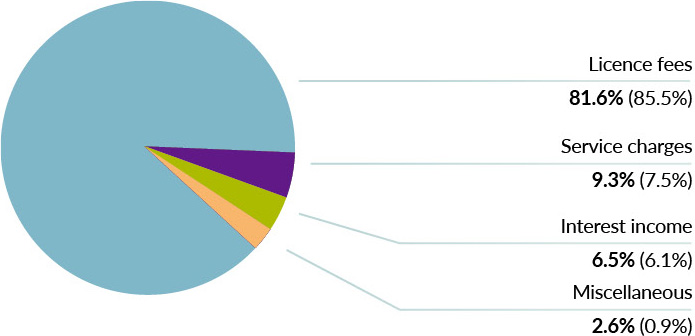

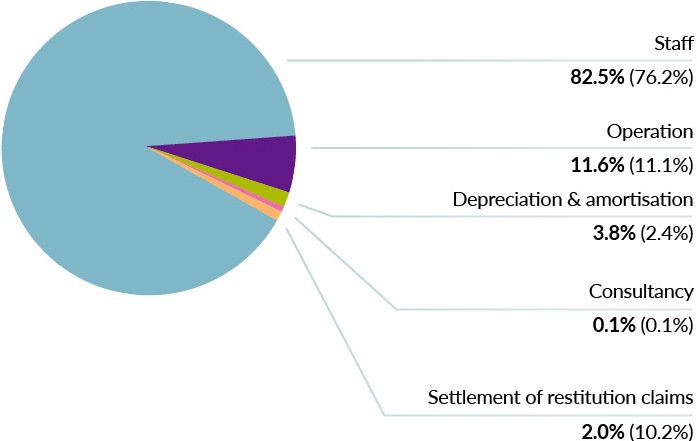

| 2020/21 HK$'m |

2019/20 HK$'m |

|

|---|---|---|

| Revenue | 481.9 |

476.2 |

| Expenditure | 478.0 |

513.4 |

| Profit / (Loss) | 3.9 |

(37.2) |

| Rate of return on ANFA | -12.8% |

-10.0% |